If you’re new to the world of checks, it’s easy to get confused. Although some types of checks (such as personal checks) are most common, each type of check is best suited for a specific situation. For example, payment of monthly rent for housing or a long-awaited car purchase — different types of checks are used for different situations.

While paper checks are a bit old-fashioned, they are still a popular commercial instrument. Understanding the different kinds of checks will help you decide which one will be the most profitable and suitable for a particular transaction.

Let's review the different types of checks from banks.

How Many Different Types of Checks Are There

So, there are seven main types of bank checks. Although there are also other kinds of checks, we will focus on the main ones:

- Personal checks;

- Cashier’s checks;

- Certified checks;

- Business checks;

- Electronic checks;

- Traveler’s checks;

- Insurance checks.

Let’s take a closer look at each check type.

Personal Checks

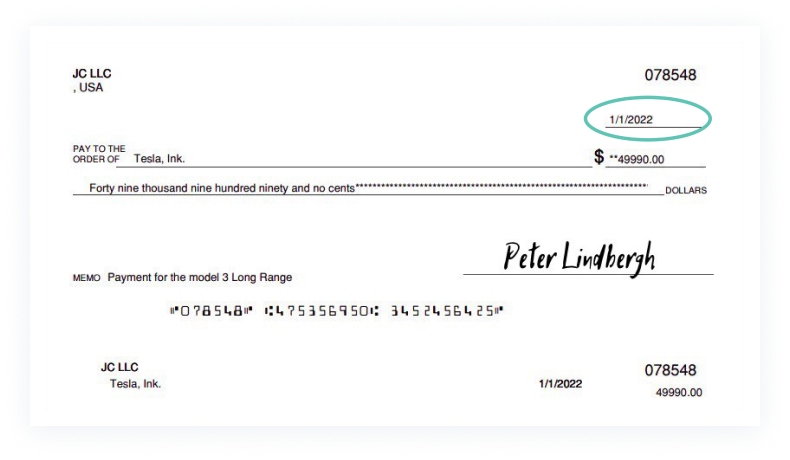

The type of check you are most likely familiar with is personal checks. A personal check is a paper statement from your bank that you, the account owner, sign. The payment is extracted from your personal account using the current account number, the routing number, the payment amount, and the name of the payee.

You should be aware that personal checks are not secure. What does it mean? The payee cannot cash the check if there are not enough funds in your bank account. Thus, receiving the money depends on sufficient funds in the issuer’s account. Moreover, there are cases in which writing a check with insufficient funds can cause an overdraft fee.

Personal checks are best suited for payments of a personal nature, such as rent, utility bills, payment for services, etc. Also, personal checks are standard in peer-to-peer payments (or P2P payments) — the transfer of funds from one person to another without direct participation from a third party.

CTA: You can print personal checks at Checksify in seconds! Try now! Button: Learn More

Cashier’s Checks

A cashier’s check is usually used to complete a major transaction. The account holder debits the amount to their bank for the transaction, and when the check is written, it is guaranteed by the financial institution. That’s why this type of check is signed by a bank representative (cashier).

Cashier’s checks assure that the person receiving the check will get the total amount due to them. Payees request cashier's checks, usually for large amounts. For example, it could be a down payment on a house or car, a significant renovation, or any other big purchase.

If you need a cashier’s check, you receive it personally at your bank branch. Also, depending on the bank, you can find this type of check online. The peculiarity of cashier’s checks is that the account holder will have to work directly with the bank to complete the payment process.

Certified Checks

Speaking about different types of checks, it is worth mentioning certified checks. Certified and cashier’s checks are often confused, as they are a bit similar, but we will explain their fundamental differences.

Certified checks, like cashier’s checks, are insured by a bank or any other financial institution. However, this is where their main difference lies — in certified checks, funds are withdrawn from the personal settlement account of the account holder, while in cashier’s, bank funds are used.

In such checks, the bank checks the account holder’s signature and confirms that enough money is in their deposit account to complete the transaction. Like cashier’s checks, certified checks are designed for customers with more significant expenses, from several thousand dollars and more.

Business Checks

The next significant type of bank check is business checks. A business check is linked to a business bank account, not a personal one. This type of check allows its owner to receive funds from a business account.

CTA: Need to print business checks? Try Checksify right now and generate your first business check!

Electronic Checks

Electronic checks, also called e-checks, have the fastest process. With its help, funds are transferred online from the payer’s account to the recipient's account. Therefore, this type of check is deservedly considered the quickest since everything happens online without the involvement of paper checks. Also, you do not need to carry a checkbook around with you.

However, electronic checks should be distinguished from credit cards. E-checks take money from your bank account but do not provide you with credit, unlike cards. Moreover, electronic checks are often more beneficial, as they usually have lower processing fees than credit card payments, and some e-checks are not subject to any fees at all.

Traveler’s Checks

Traveler’s checks are another type of basic check. Travelers frequently use them to pay for goods internationally and buy local currency. However, these checks have become less common as credit and debit cards are more popular and easier to use.

Also, if you need a traveler's check, keep in mind that large banks rarely offer them, but you can still get them at some small ones, being an account holder there.

Insurance Checks

After proving an insured event, an insurance company issues an insurance check, which insurance undertakes to cover. For example, your house was damaged in a tsunami or a fire while insured, or you were in a car accident, and your car needs to be repaired.

In all insured cases, you can claim such a check and receive payment from your insurance. Also, insurance checks are often issued to two parties, such as you and the body shop fixing your car, to ensure that the funds are being used as intended.

Insurance Checks

After proving an insured event, an insurance company issues an insurance check, which insurance undertakes to cover. For example, your house was damaged in a tsunami or a fire while insured, or you were in a car accident, and your car needs to be repaired.

In all insured cases, you can claim such a check and receive payment from your insurance. Also, insurance checks are often issued to two parties, such as you and the body shop fixing your car, to ensure that the funds are being used as intended.

Additional Types of Checks

Additional checks include government checks, tax refund checks, bearer checks, and blank checks.

- A government check is a check issued to you by the government. These can be checks related to financial assistance and social security, government subsidies, unemployment benefits, etc.

- The tax refund check is a type of government check that many taxpayers receive. The IRS (Internal Revenue Service) provides this check to taxpayers eligible for tax refunds.

- Bearer checks are used by the originator of the transaction, the payer, and allow the payee (bearer) to order a trade from the bank, resulting in the payer receiving funds from the financial institution.

- A blank check is a personal check in which the issuer leaves the amount field blank. The recipient can then enter their amount and cash the check as usual. This is a relatively rare check, although it is often shown in Hollywood films. The liability is too high since there is a possibility that the recipient will issue an amount much higher than the amount that the issuer can pay.

Which Check Type Is Right for Me?

To finally decide which type of bank check is right for you, pay attention to the features of using different checks in the table.

| Check Type | Usage Features |

| Personal check |

Ideal for personal purchases and payment for services (rent, utility bills, pay for services), as well as P2P payments. |

| Cashier’s check | Ideal for large purchases of several thousand dollars and more (down payment for a house, car, etc.) |

| Certified check |

The main difference with cashier's checks: in certified checks, funds are withdrawn from the personal settlement account of the account holder, while in cashier's, bank funds are used. Also ideal for large purchases. |

| Business check | They are usually used to pay salaries (payroll checks) and other expenses related to business. |

| Electronic check | With their help, funds are transferred online from the payer's account to the recipient's account. Also, you do not need to carry a checkbook around with you. |

| Traveler’s check | Travelers use them to pay for goods internationally and buy local currency. |

| Insurance check | They are used after proving an insured event, which insurance covers. |

| Government check | Issued by the government: financial assistance and social security, government subsidies, unemployment benefits, etc. |

| Tax Refund check | The IRS (Internal Revenue Service) provides this check to taxpayers eligible for tax refunds. |

| Bearer check | Allows the payee (bearer) to order a trade from the bank, resulting in the payer receiving funds. |

| Blank check | A personal check in which the issuer leaves the amount field blank. The recipient can then enter their amount and cash the check as usual. |

Jim Elgart is a licensed CPA with 10+ years of experience as a CFO for various mid-market companies. After spending more than 20 years as an accounting and business development manager, Jim became CFO and CEO of Checksify— an online platform for business owners, bookkeepers, and individuals to generate and print checks.