Handwriting checks seem pretty old-fashioned. But, since childhood, most of us have watched our parents do this “adult” business of filling out checks.

However, despite all the digitalization of this world, there are situations when it is simply necessary to know how to write a check. If you are not an expert in this matter, then a million fears arise, mainly with filling in the data incorrectly.

We will permanently relieve you of this discomfort and tell you how to make writing checks as simple as possible by following a few super-simple steps.

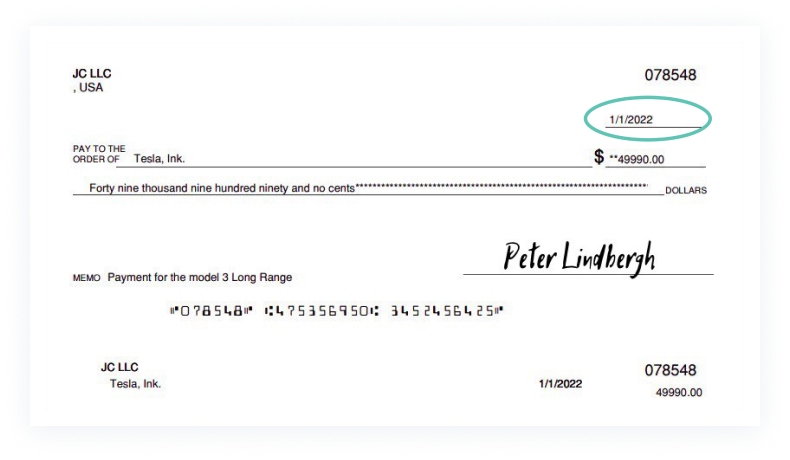

Step 1. Write Check Date

The first step is as simple as ABC. First, fill in the date in the upper right corner of the check. You must write the current date (the date you are signing the check). It is also common for people to postdate by writing the future signing date. This does not affect your check sample in any way since it becomes a means of payment only after it is signed. Enter the day, month, and year in the date box to properly fill out a check.

For example, “Jan 1, 2022” or 1/1/2022”

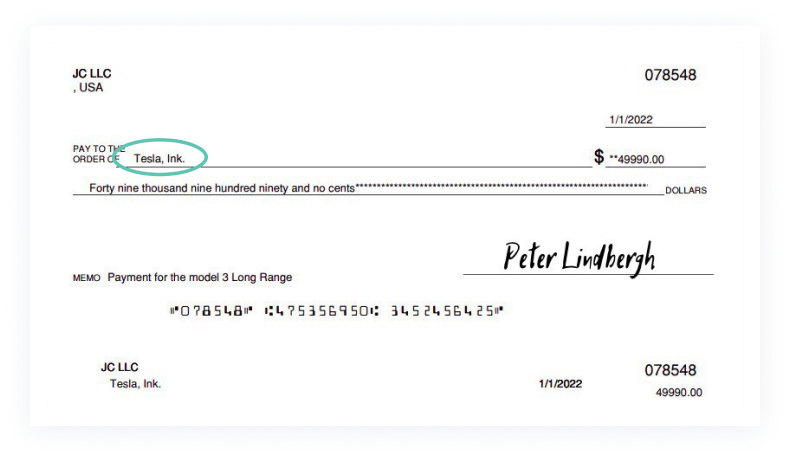

Step 2. Add Recipient Name

When you write a check, the next logical step is the person's name to whom it is intended. This can be any natural or legal person (company, school, corporation, etc.) with a bank account. For an individual, be sure to indicate the first and last name, and for an organization, use the full name. Finally, it is always worth checking the spelling of the name, although the banks are relatively lenient on this.

For example, “Harry Potter” or “Tesla, Ink.”

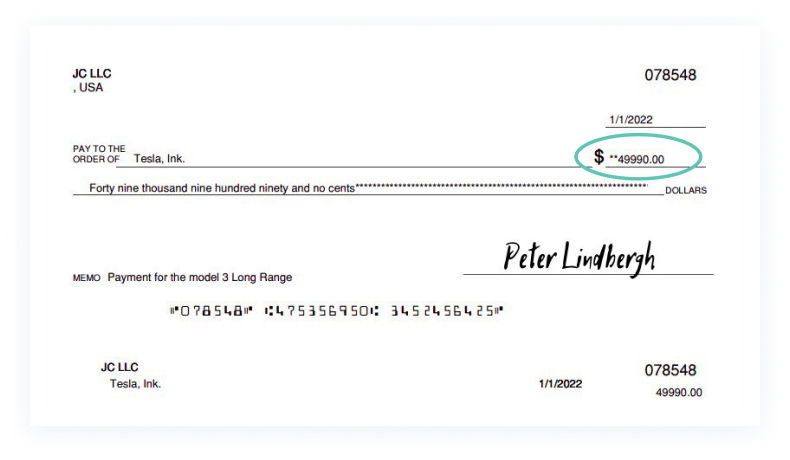

Step 3. Write the Amount in Numbers

To write a check correctly, you need to put the transfer amount in numbers. Write the total dollar and cents in the box on the right-hand side below the date. To prevent fraud, experts advise placing the first digit right up against the left-hand border of the dollar box. Also, there’s no need to write your own dollar sign.

If while writing a check, you accidentally put the wrong numbers (shit happens!), it's not a tragedy. Just cross out the incorrect value with a line, write the new number, and put your initials next to it.

For example, “49990.00”

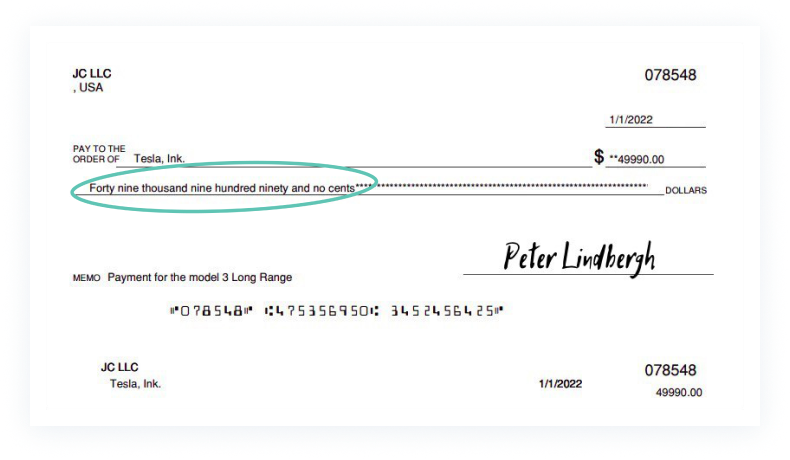

Step 4. Write the Amount in Words

While this step may seem like an unnecessary repetition when filling out a check, it doubles your security. Firstly, it will also save you from fraud because numbers are easier to add or correct than letters. Secondly, spelling the transfer amount in words will confirm that you indicated the correct amount of money in the check.

Also, during check writing, you should write out the cash in dollar value — cents can be represented in numbers.

For example, “Forty-nine thousand nine hundred ninety and 50 cents” or “Forty-nine thousand nine hundred ninety and no cents”

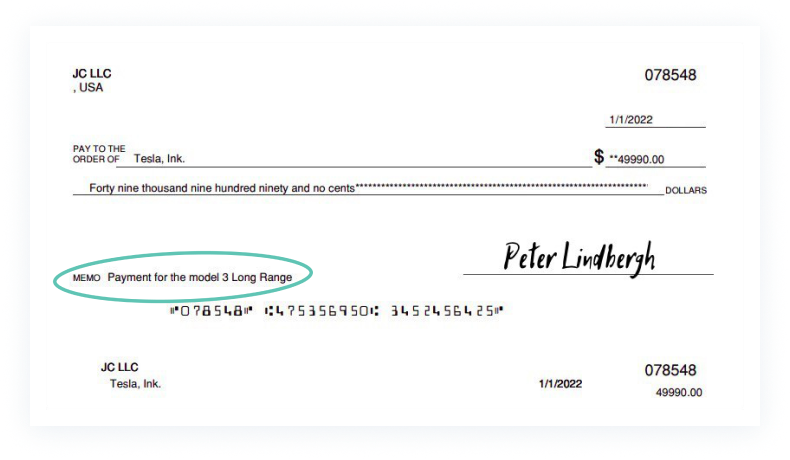

Step 5. Fill In the Memo (Additional Info)

If you want to know how to write a check properly, the next step involves filling in the “memo” field. If you want to add more information, you can do so in this gap.

Although this step is optional when writing the check, it has advantages. This line is convenient if you pay for something at your child's school. Then in the memo, you can indicate the child's name and grade. In addition, the memo can clarify your purchase or payment of something — for example, monthly rent for an apartment or dinner with friends.

For example, “Payment for the model 3 Long Range”

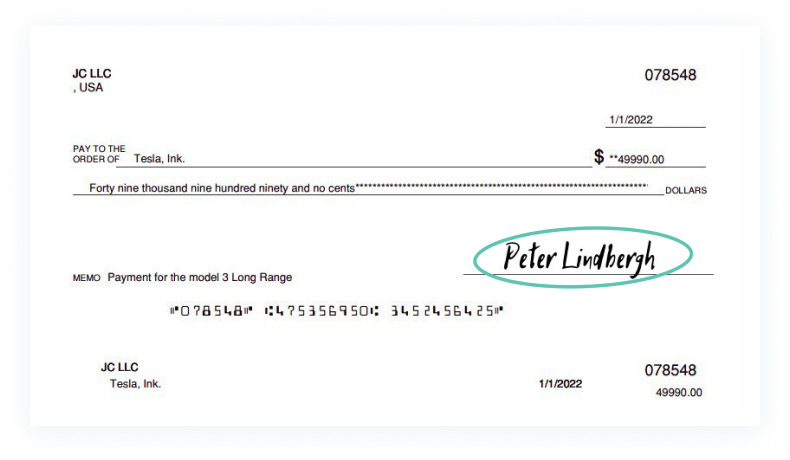

Step 6. Sign the Check

The check you write must have your signature. Sign your name on the line in the lower right corner of the check. The signature is required since the check becomes a payment instrument, and the recipient can receive the money.

If you are looking for the correct way to write a check, this step is final and necessary. Also, remember that before you sign the form, you need to double-check all the information and make sure it is correct. Ready! Now you know how to write a check. Congratulations!

For example, “Peter Lindbergh”

Additional Tips for Writing a Check

When you write the check, make sure you have followed all the necessary security steps. Your check, unfortunately, has a lot of chances to get lost after you let go of it. So to keep yourself safe from fraud, follow these simple steps.

Use the same signature.

Often, people have an illegible signature, and for some, it is even okay to sign checks with emoticons. Take this topic seriously. After all, the constant use of the same signature helps banks identify fraud. Moreover, if someone else uses your check, it will be easier to prove that you had nothing to do with it.Use a pen that cannot be erased.

This rule seems primitive, but often people are not very worried and fill out their checks with a pencil. Don't risk getting caught by a cunning person with an eraser who can change the check amount and the payee's name.Do not leave checks blank.

Do not allow situations where you signed a check without the payee's name and the amount. If you don't know this information at the moment, it's better to bring a pen with you for when you do. But you definitely shouldn't risk your data by giving anyone access to your account.Use your register to balance your checking account.

This action will allow you to double-check every transaction in your bank account. You will learn about errors, if any, in your account. Also, you can figure out if anybody has failed to deposit a check you wrote.Try to write fewer checks.

This is still the least secure payment method. No paper can be lost or stolen when you pay for something with your card. How to write a check safely? Unconditionally following our advice!Frequently Asked Questions

Yes, you can write your name on the check in the recipient's line and cash it out. Also, it is an effective and widespread way to transfer money from one account to another.

Yes. Whenever you write the payment amount in words, draw a line after the last letter. This will protect you from somebody adding an extra amount. Also, whenever you write the sum in the small box below the date, do it as close to the dollar sign as possible. It will keep you safe from someone adding more numbers.

Although you can write a check for cash, it is not very secure. Since you are not specifying the recipient's name, anyone can cash it. However, if you still need to do this, write in the Pay to the Order Of line — “cash.”

Yes, it does, but there is a slight nuance. Often people postdate their checks because they may not have funds in their account on the day they write the checks. This ensures that checks are not cashed or deposited before the date.

Jim Elgart is a licensed CPA with 10+ years of experience as a CFO for various mid-market companies. After spending more than 20 years as an accounting and business development manager, Jim became CFO and CEO of CHECKSIFY — an online platform for business owners, bookkeepers, and individuals to generate and print checks.